David Wray, founder of DW Group, and Marie-Josée Privyk, president of FinComm Services, recently shared their insights on the European Commission’s August 2024 FAQs with the Institute of Chartered Accountants in England and Wales (ICAEW).

The FAQs are designed to help companies navigate the Corporate Sustainability Reporting Directive (CSRD) requirements.

A key focus of these FAQs is the recognition and reporting of intangible resources, which play a crucial role in value creation.

The FAQs address whether companies must report on intangible assets not recognised on the balance sheet.

The answer is affirmative, underscoring the need to consider all intangibles, in assessing a company’s potential for value creation.

The guidelines also specify that all companies within the CSRD’s scope must provide information on key intangible resources.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe CSRD preamble clarifies that the Accounting Directive does not mandate the disclosure of intangible resources other than those recognised on the balance sheet.

Internally generated intangible assets hold low or no value on the balance sheet, while acquired assets are recognised at cost.

Additionally, the cost of a separately acquired intangible asset can be measured reliably, especially when purchased with cash or other monetary assets.

This highlights the limitations of existing standards in recognising or measuring intangibles, which may not be reflected in financial statements.

A review of IAS 38 is underway by the IASB, with the UK Endorsement Board monitoring the IASB public consultation on intangibles.

The European Commission’s response to the first question emphasises a holistic approach to considering all intangibles.

This enables users to understand a company’s dependence on key intangible resources and their relevance to future value creation, regardless of recognition and measurement criteria in the applicable accounting framework.

The European Commission’s FAQs specify that information on intangibles not meeting financial accounting requirements need not be included in the sustainability statement.

Instead, it may be provided in a different section of the management report.

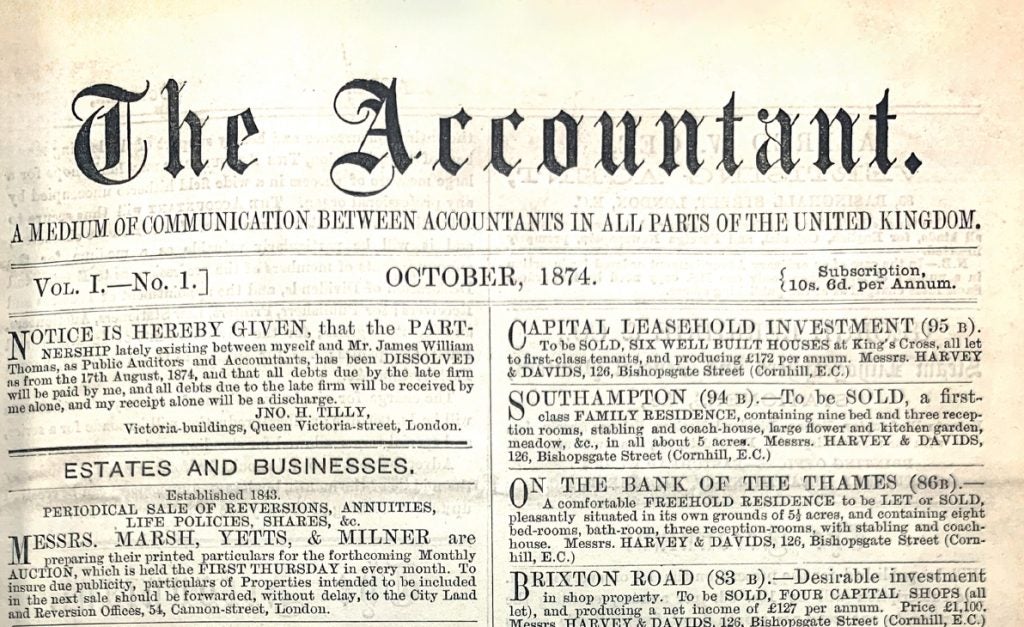

In October 2024, ICAEW announced an overhaul of its Associate Chartered Accountant (ACA) qualification.